Virtual Asset Service Providers Challenging Binance's Lead in Global Bitcoin Trading

The competitive landscape of the cryptocurrency industry is undergoing a major shift as the exchanges battle for a larger slice of the global Bitcoin trading market. While Binance, the world's largest crypto exchange, has long held a dominant position in non-US Bitcoin trading, its rivals are now making significant inroads, thanks in part to the evolving regulatory environment in key virtual asset hubs around the world.

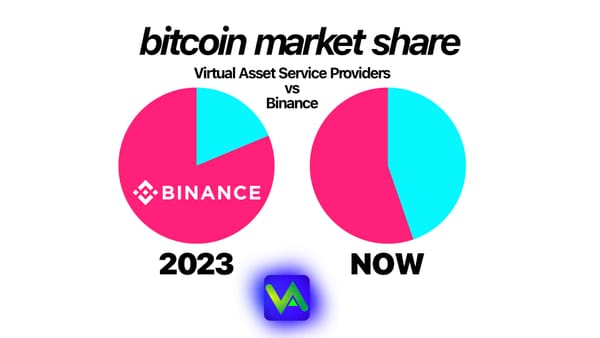

According to data from research firm Kaiko, Binance's share of Bitcoin trading outside the United States has dropped from a commanding 81.3% to 55.3% over the past year. The exchange has also seen its share of altcoin trading, which includes smaller tokens, fall from 58% to 50.5% during the same period.

This shift in market dynamics can be attributed to several factors, including the aggressive expansion efforts of Binance's competitors and the introduction of new regulations in Dubai, Hong Kong, and the United Kingdom. As these virtual asset hubs have moved to establish clear guidelines and licensing requirements for virtual asset service providers, a growing number of exchanges have seized the opportunity to establish a presence in these markets and capture a larger share of the global crypto trading volume.

Be sure to see our previous coverage:

- Dubai Virtual Asset Service Providers

- Hong Kong Virtual Asset Service Providers

- London Virtual Asset Service Providers

One of the key drivers behind this trend has been the UAE's push to become a global hub for virtual assets. In 2022, the country introduced a comprehensive regulatory framework for crypto assets, which has attracted a number of major players in the industry. Dubai, in particular, has emerged as a popular destination for crypto exchanges, with Binance and Crypto.com securing licenses to operate in the city with Dubai's Virtual Asset Regulatory Authority (VARA).

Similarly, Hong Kong has taken steps to clarify its regulatory stance on virtual assets, with the Securities and Futures Commission (SFC) introducing a new licensing regime for crypto exchanges in 2023. This move has encouraged a number of exchanges to set up shop in the city, including Huobi, OKX, and Bitfinex.

London, too, has seen a surge in crypto exchange activity following the introduction of the UK's new regulatory framework for virtual assets. The Financial Conduct Authority (FCA) has granted licenses to a number of exchanges, including Coinbase, Kraken, and Bitstamp, as the country looks to establish itself as a leading center for crypto innovation.

As these regulatory changes have taken hold, Binance's rivals have been quick to capitalize on the opportunities presented by these new markets. Many have invested heavily in obtaining the necessary licenses and building out their local infrastructure, allowing them to offer a more comprehensive range of services to users in these regions.

This increased competition has put pressure on Binance to adapt its strategy and explore new avenues for growth. The exchange has responded by expanding its presence in key markets such as the UAE and Hong Kong, while also diversifying its product offering to include a wider range of trading pairs and derivatives products.

Despite these efforts, however, Binance's market share has continued to erode as its rivals gain ground. This trend is likely to continue in the coming years as more countries move to establish clear regulatory frameworks for virtual assets, creating new opportunities for exchanges to compete on a level playing field.

The shifting competitive dynamics in the crypto industry also highlight the growing importance of regulatory compliance in the eyes of both users and investors. As the market matures and becomes more mainstream, exchanges that can demonstrate a strong commitment to adhering to local regulations and protecting user funds are likely to gain a significant advantage over those that prioritize growth at all costs.

In this context, the battle for global Bitcoin trading dominance is likely to be won not just by the exchange with the most innovative technology or the lowest fees, but by the one that can navigate the complex web of regulations and build trust with users in key markets around the world.

As the crypto industry continues to evolve and mature, it will be fascinating to watch how the competitive landscape shifts in response to changing regulations and user demands. One thing is clear, however: the days of Binance's unchallenged dominance in the global Bitcoin trading market are numbered, and the exchange will need to work harder than ever to maintain its position at the top of the pile.