What is a Central Bank Digital Currency (CBDC)?

Learn what a CBDC (Central Bank Digital Currency) is, the types, benefits, challenges, and the current state of CBDC development worldwide.

This article "What is a CBDC" is one of our most popular articles on VirtualAssets.com.

Central Bank Digital Currencies (CBDCs) are a hot topic in the world of finance, with over 100 countries exploring or developing their own digital currencies. But what exactly are CBDCs, and why are they generating so much buzz?

Definition

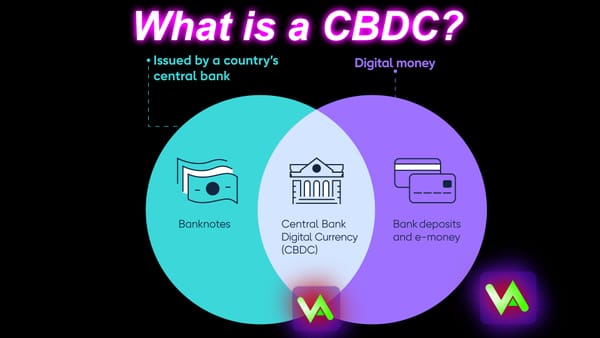

A Central Bank Digital Currency (CBDC) is a digital form of a country's fiat currency, issued and backed by the central bank. Unlike cryptocurrencies such as Bitcoin, which are decentralized and not backed by any government, CBDCs are centralized and carry the full faith and credit of the issuing country.

Types of CBDC

There are two main types of CBDCs:

-

Retail CBDCs: These are designed for use by the general public, similar to physical cash. They could be used for everyday transactions and would be accessible through digital wallets or accounts.

-

Wholesale CBDCs: These are intended for use by financial institutions for interbank settlements and large-value transactions. They could improve efficiency and reduce settlement risks in the financial system.

Some countries are also exploring hybrid models that combine features of both retail and wholesale CBDCs.

Potential Benefits of CBDCs

Proponents of CBDCs argue that they could offer several benefits, including:

-

Financial inclusion: CBDCs could provide access to digital payments and financial services for unbanked or underbanked populations, particularly in developing countries.

-

Improved efficiency: Digital currencies could enable faster, cheaper, and more secure transactions compared to traditional payment systems. Cross-border payments could also become more streamlined.

-

Monetary policy tools: CBDCs could give central banks new tools to implement monetary policy, such as the ability to set interest rates on digital currency holdings or to distribute stimulus payments directly to citizens.

-

Reduced costs: Issuing and managing digital currencies could be less expensive than printing and distributing physical cash.

-

Combating illicit activities: CBDCs could make it easier for authorities to track and prevent money laundering, terrorist financing, and other illegal transactions.

Challenges and Risks

Despite the potential benefits, CBDCs also raise several concerns and challenges, such as:

-

Privacy: There are fears that CBDCs could enable greater surveillance and erosion of financial privacy, as all transactions would be recorded and potentially accessible to authorities.

-

Cybersecurity: As digital assets, CBDCs could be vulnerable to hacking, cyber attacks, and other security breaches.

-

Financial stability: The introduction of CBDCs could disrupt the existing financial system, potentially leading to disintermediation of banks and changes in credit provision.

-

International implications: CBDCs could have geopolitical ramifications, such as threatening the dominance of the U.S. dollar or enabling countries to circumvent international sanctions.

-

Public acceptance: The success of CBDCs will depend on whether consumers and businesses trust and adopt them. Education and outreach efforts may be necessary to drive widespread usage.

Current State of CBDC Development

Several countries have already launched CBDCs, including the Bahamas (Sand Dollar), Nigeria (eNaira), and Jamaica (JAM-DEX). China has been piloting its digital yuan (digital RMB or e-CNY) in several cities and plans to expand its use.

Many other countries, including the US, UK, Canada, and members of the European Union, are actively researching and experimenting with CBDCs. The IMF and other international organizations are also providing guidance and support for CBDC development.

Looking Ahead

The rise of CBDCs represents a significant evolution in the nature of money and payments. While the exact form and impact of CBDCs remain to be seen, it is clear that they have the potential to reshape the global financial landscape.

Central banks and policymakers will need to carefully weigh the benefits and risks of CBDCs and engage in extensive stakeholder consultations and public outreach. Designing and implementing CBDCs will require addressing complex technical, legal, and regulatory challenges.

As more countries move forward with CBDC projects, it will be crucial to ensure interoperability and coordination across borders to realize the full potential of digital currencies. The coming years are likely to see rapid advancements and experimentation in this space, with important implications for consumers, businesses, and the global economy.

Frequently Asked Questions (FAQ)

What is a Central Bank Digital Currency (CBDC)?

A Central Bank Digital Currency (CBDC) is a digital form of a country's fiat currency, issued and backed by the central bank. It is centralized and carries the full faith and credit of the issuing country, unlike decentralized cryptocurrencies.

How does a CBDC differ from cryptocurrencies like Bitcoin?

CBDCs are issued and regulated by a country's central bank and are centralized, while cryptocurrencies like Bitcoin are decentralized and not backed by any government or central authority.

What are the main types of CBDCs?

There are two main types of CBDCs: Retail CBDCs, designed for public use in everyday transactions, and Wholesale CBDCs, intended for financial institutions for interbank settlements and large-value transactions.

What are the potential benefits of CBDCs?

CBDCs can offer benefits such as financial inclusion, improved transaction efficiency, new monetary policy tools, reduced costs of issuing physical cash, and enhanced ability to combat illicit activities.

What challenges and risks are associated with CBDCs?

Challenges include privacy concerns, cybersecurity risks, potential disruption to financial stability, geopolitical implications, and the need for public acceptance and trust.

Which countries have already launched CBDCs?

Countries that have launched CBDCs include the Bahamas (Sand Dollar), Nigeria (eNaira), and Jamaica (JAM-DEX). China is also piloting its digital yuan (e-CNY) in several cities.

How can CBDCs improve financial inclusion?

CBDCs can provide access to digital payments and financial services for unbanked or underbanked populations, especially in developing countries, by enabling easier and more inclusive financial transactions.

What role can CBDCs play in cross-border payments?

CBDCs have the potential to streamline cross-border payments by reducing transaction times, lowering costs, and enhancing security compared to traditional international payment systems.

Are there privacy concerns with CBDCs?

Yes, there are concerns that CBDCs could lead to greater surveillance and erosion of financial privacy since all transactions would be recorded and potentially accessible to authorities.

How will the introduction of CBDCs affect traditional banks?

The introduction of CBDCs could disrupt the existing financial system, potentially leading to disintermediation of banks, changes in credit provision, and shifts in the way financial services are delivered.