90 Jurisdictions Open Their Doors to Virtual Assets

The virtual asset landscape is evolving, with 151 jurisdictions worldwide making significant decisions about the future of cryptocurrencies and Virtual Asset Service Providers (VASPs).

Survey Overview: Virtual Assets

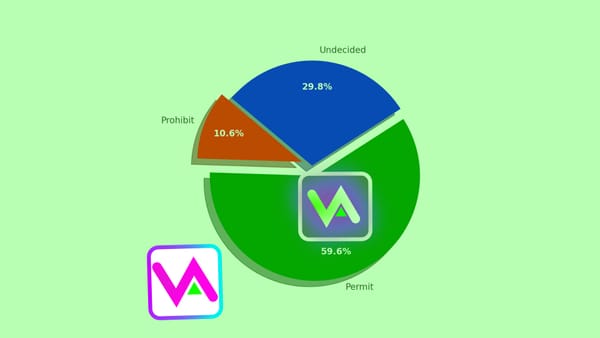

The global stance on virtual assets and VASPs is largely secure, with 90 jurisdictions opting to permit and regulate the use of virtual assets and VASPs. This approach signifies a willingness to embrace innovation, according to our latest survey of the market. Here's a quick breakdown of the findings:

-

Prohibit the Use of Virtual Assets and VASPs: 16 jurisdictions have opted to prohibit both virtual assets and the operation of VASPs within their borders, reflecting a cautious or conservative approach to the rapidly evolving digital asset space.

-

Permit the Use of Virtual Assets and VASPs: A significant majority, 90 jurisdictions, have decided to permit and regulate the use of virtual assets and VASPs. This approach signifies a willingness to embrace innovation while addressing the potential risks associated with virtual assets through regulation.

-

Undecided on Virtual Assets and VASPs: 45 jurisdictions remain on the fence, having not yet decided their stance on virtual assets and VASPs. This indecision could stem from a variety of factors, including regulatory challenges, economic considerations, or waiting to observe how other regions navigate the complex landscape.

Implications for the Virtual Asset Ecosystem

The divergent approaches taken by jurisdictions worldwide have profound implications for the future of virtual assets and VASPs. Those that have embraced these innovations with open arms are positioning themselves as potential leaders in the burgeoning digital economy, attracting businesses and investors looking for a supportive regulatory environment.

Conversely, jurisdictions that have opted for prohibition might be exercising caution against the backdrop of volatility and regulatory concerns associated with cryptocurrencies. However, this stance could also limit their participation in the growing digital asset market, potentially sidelining them from the economic benefits it offers.

The undecided jurisdictions represent a significant portion of the global landscape, indicating ongoing debates and deliberations about the best path forward. The decisions these jurisdictions eventually make could tip the global balance in favor of widespread adoption or cautious regulation.

A World at a Crossroads

The global jurisdictional survey on virtual assets and VASPs underscores a world at a crossroads. As digital currencies and blockchain technology continue to evolve, the decisions made by these jurisdictions will shape the future of finance, technology, and global commerce. The coming years will likely see shifts in these stances as the implications of virtual assets and VASPs become clearer, and jurisdictions strive to strike a balance between innovation, regulation, and economic opportunity.